You'll receive a tax acknowledgement letter along with the car or truck are going to be bought to provide assistance for your American Crimson Cross.

Whenever your automobile is picked up, the driving force will provide you with an First donation receipt. You might claim as many as $five hundred on the donation even when your car sells for much less. If your car or truck sells for over $500, we will provide a 1098-C IRS type which will enable you to assert the entire sale cost.

A: After your car or truck is bought, the advertising selling price gets the level of your donation. If your automobile sells for over $five hundred, it's possible you'll deduct the entire providing price tag. If the motor vehicle sells for $five hundred or less, you are able to deduct the “honest sector benefit” of your car or truck, approximately $five hundred.

In just 24 hours of the subsequent enterprise day, we Call you to definitely program absolutely free pick up for automobile donations. We come to you and pick up your automobile without cost!

Beneath the new tax law, you happen to be probably pondering just how your car donation will have an affect on your deductions this yr. Here's the deal: it's not as complex as you may count on. This is a breakdown of the principle adjustments:

When you create a auto donation, step one during the donation process is analyzing the fair industry value of your automobile. This figure, not just the cost you paid out when you obtain it, is The true secret to your vehicle donation tax deduction.

Beware of 'charities' in which you You should not see their superior is effective click here inside your Neighborhood. Numerous vehicle donation businesses that assert to aid Young ones or kars will often be deceiving perfectly supposed donors with lovable Internet websites and jingles. For more info on these unscrupulous functions, you can accessibility valuable data listed here:

Question us how you can become involved and assistance the combat towards most cancers. A number of the subject areas we are able to guide with contain:

Like a number of other charities, this one particular is dependent upon Charitable Adult Rides and Solutions to read more method donated autos. Acknowledged automobiles include things like Virtually just about anything that has an engine, is in the U.S., is in one piece and may be towed.

Blueprint is undoubtedly an unbiased publisher and comparison assistance, not an investment advisor. The information provided is for educational functions only and we motivate you to read more seek personalized advice from qualified experts relating to particular monetary or health-related choices. Person final results might fluctuate. Previous efficiency just isn't indicative of upcoming success.

As most charities that settle for car or truck donations do so typically, they’ll possible have the process right down to a science and take care of all of the donation click here documentation paperwork required through the IRS to suit your needs.

Make sure you attain the required tax kinds. Continue to keep an in depth report, You will need it when tax period arrives.

If your motor vehicle is offered via the Business for an important low cost to some needy specific, the gross proceeds rule does not apply. Instead, you might be allowed to claim a deduction dependant here on the vehicle's good market value.

Non-financial gain organizations can both make use of your automobile or offer it and utilize the proceeds to further more their charitable missions. A lot of take every kind of cars in Virtually any condition.

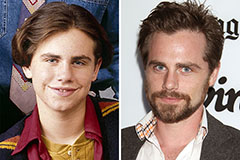

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Anthony Michael Hall Then & Now!

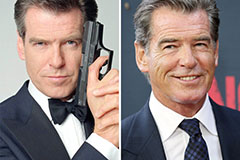

Anthony Michael Hall Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!